10/30/2024 | Whether you’re a commercial real estate lender, owner, or investor, your biggest CRE decisions hinge on property value.

In today’s somewhat volatile market, identifying shifts in value is important. Getting a quick value estimate early in a transaction or checking on assets under management is quite different than a full appraisal needed for loan origination. Knowing the available tools and when to use them is essential and can save time and money. In this webinar, CREtelligent’s Jack Stanton teamed with Clear Capital’s Gregory LaPlaunt to discuss the various valuation tools available and the different use cases when you would use one over another.

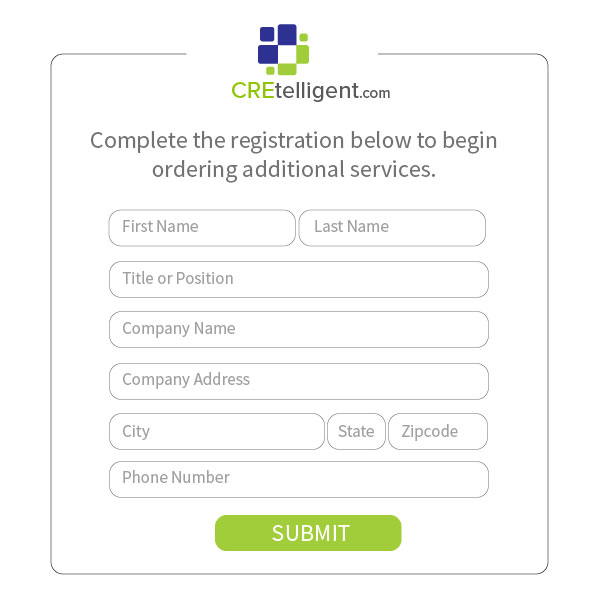

About CREtelligent.com. Commercial Real Estate Due Diligence. Simplified.

Gold River, CA-based CREtelligent opened its doors in 2015 as eScreenLogic, a Commercial Real Estate (CRE) environmental due diligence firm focused on desktop, RSRA, Phase I, and Phase II site assessments. In late 2020, eScreenLogic rebranded to CREtelligent to better reflect the company’s vision. Since then, the company has grown quickly and today provides the full spectrum of property due diligence services to commercial real estate professionals.

Media Contact: Gary Kulik | g.kulik@cretelligent.com